FOR EVERYONE

Any age or fitness level - all are welcome

PRIVATE SUITES

avoid the crowds - no judgement, no distractions, no waiting for equipment.

CUSTOMIZED

workout programs as unique as you - built to overcome any obstacle.

ACCOUNTABILITY

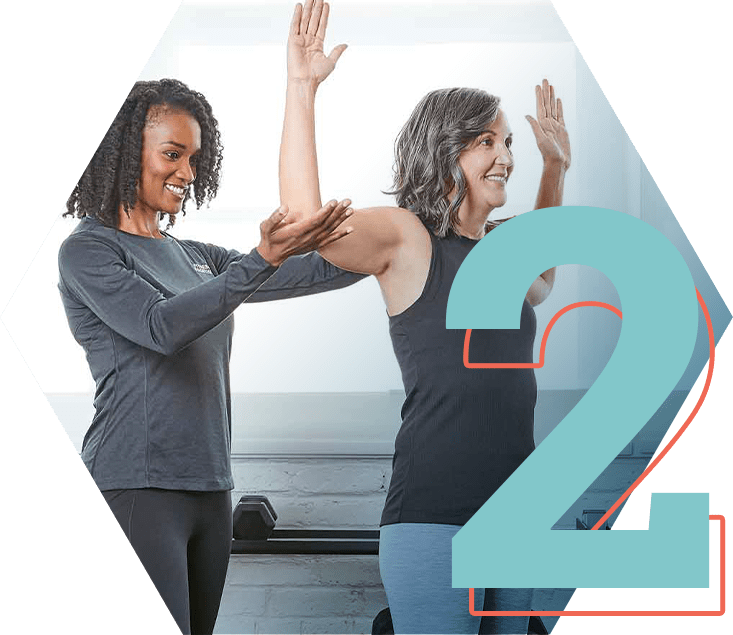

certified personal training team - your goals are their goals.

RESULTS

real time adjustments and progressive programming to stay on track.

about our personal training

Welcome to your second home. You are unique and your training should be, too. No matter your age or fitness level, we are invested in helping you reach your personal goals because we take your health, well….personally. We don’t just jump in - we take the time to get to know you and understand where you are starting on your wellness journey, all before an experienced personal training team member creates your custom workout program to put you on the path to success. Whether you’re training in-studio or training virtually, we’re in this together.

here’s how it works

complimentary

signature fit evaluation

A complimentary signature process where we learn about your goals, health history, and take you through a mini workout so we have the information we need to begin building your customized program.

full body assessment

A comprehensive fitness assessment to collect baseline metrics that will help us track your progress.

personal training session

Meet your trainer in your private suite (or virtually) for your 1:1 session to begin your completely customized workout program.

progress checks

A comprehensive assessment every 6 weeks so we can celebrate your progress and set new goals.